Oklo Inc.

Executive Summary

Oklo Inc. is an innovative nuclear energy company pioneering advanced fission technology with its Aurora powerhouse design. Founded in 2013, Oklo aims to revolutionize the energy sector by developing small, modular fast reactors that can provide clean, reliable, and cost-effective power.

Key highlights of Oklo's valuation:

- Disruptive Technology: Oklo's advanced fission reactors have the potential to transform the nuclear energy landscape, offering a safer and more efficient alternative to traditional nuclear plants.

- Regulatory Progress: The company has made significant strides in the regulatory process, becoming the first advanced fission company to have a license application accepted for review by the U.S. Nuclear Regulatory Commission.

- Market Opportunity: With growing demand for clean energy solutions, Oklo is well-positioned to capitalize on the expanding nuclear power market, estimated to reach $28 billion by 2030.

- Financial Outlook: While specific financial data is limited due to Oklo's private status, the company has secured substantial funding and partnerships, indicating strong investor confidence.

- Valuation Challenges: As an early-stage company in a highly regulated industry, traditional valuation methods may not fully capture Oklo's long-term potential, necessitating a more nuanced approach.

Investment Thesis

Oklo presents a compelling investment opportunity based on its:

- Innovative technology with the potential to disrupt the energy sector

- Strong regulatory progress and first-mover advantage

- Substantial addressable market in the clean energy transition

- Experienced management team with deep industry expertise

Risk Factors

Key risks to consider include:

- Regulatory hurdles and potential delays in licensing processes

- Competition from other advanced nuclear technologies and renewable energy sources

- Public perception and acceptance of nuclear energy

- Execution risks associated with scaling up operations and commercialization

Overall, Oklo Inc. represents a high-risk, high-reward investment opportunity in the clean energy sector, with the potential for significant returns if the company successfully navigates regulatory challenges and achieves commercial deployment of its advanced fission technology.

Company Overview

Oklo Inc. is a pioneering nuclear technology company founded in 2013 by Jacob DeWitte and Caroline Cochran, both graduates of the Massachusetts Institute of Technology (MIT). Headquartered in Santa Clara, California, Oklo is at the forefront of developing advanced fission technology with the goal of providing clean, reliable, and affordable energy on a global scale.

The company's name draws inspiration from the Oklo region in Gabon, Africa, where natural nuclear fission reactions occurred approximately 1.7 billion years ago. This connection underscores Oklo's commitment to harnessing nuclear power in innovative ways.

Key Aspects

Technology: Oklo specializes in designing compact fast reactors, with its flagship product being the Aurora powerhouse. The Aurora is a small-scale nuclear power plant capable of generating 15-50 MWe of electrical power using a compact fast neutron reactor.

Business Model: Oklo operates on a Build, Own, Operate model, focusing on selling power directly to customers under long-term contracts rather than selling power plants. This approach aims to provide consistent, recurring revenue and cash flow streams.

Market Position: As of May 10, 2024, Oklo Inc. became a publicly traded company on the New York Stock Exchange under the ticker symbol "OKLO". The business combination with AltC Acquisition Corp. resulted in gross proceeds of $306 million, positioning the company for growth and execution of its business plan.

Leadership: Oklo boasts a strong leadership team, with Jacob DeWitte serving as Co-Founder and CEO, and Caroline Cochran as Co-Founder and COO. The company's board of directors includes notable figures such as Sam Altman, the CEO of OpenAI, who serves as Chairman.

Partnerships: Oklo has secured key agreements with industry leaders, including partnerships with Diamondback Energy, Inc. and Centrus Energy Corp. These collaborations strengthen Oklo's position in the energy sector and support its growth strategy.

Regulatory Progress: The company has made significant strides in the regulatory landscape, including obtaining a site use permit from the U.S. Department of Energy in 2019 and submitting the first advanced reactor combined license application.

Oklo Inc. stands at the intersection of innovation and sustainability, aiming to revolutionize the energy sector with its advanced fission technology and unique business approach. As the company continues to develop and deploy its Aurora powerhouses, it has the potential to play a crucial role in the transition to clean, reliable energy sources.

Business Model

Oklo Inc. has adopted a unique Build, Own, Operate (BOO) model for its advanced nuclear technology. This approach sets Oklo apart in the energy sector, focusing on selling power rather than power plants. Here's a breakdown of their innovative business model:

Power Purchase Agreements (PPAs): At the core of Oklo's strategy are long-term Power Purchase Agreements with customers. These contracts typically span 20 years, with options to extend for another 20 years, aligning with the 40-year design life of Oklo's reactors.

Recurring Revenue Stream: By selling power directly to customers, Oklo aims to generate consistent, recurring revenue and cash flow. This model provides financial stability and predictability, which is attractive to both the company and its investors.

Customer-Centric Approach: Oklo's model simplifies the process for customers who want to access clean, reliable power without the complexities of owning and operating a nuclear facility. This approach is particularly appealing to industries with high energy demands, such as data centers, oil and gas operations, and industrial facilities.

Scalability: The Aurora powerhouse design allows Oklo to scale its offerings according to customer needs. With reactor sizes ranging from 15 MW to 50 MW (and potentially larger in the future), Oklo can tailor its solutions to various energy requirements.

Regulatory Streamlining: By retaining ownership and operation of the reactors, Oklo manages the regulatory complexities associated with nuclear power, relieving customers of this burden.

Fuel Recycling Integration: Oklo's business model incorporates nuclear fuel recycling, which can significantly reduce fuel costs and address nuclear waste concerns. This aspect enhances the economic and environmental appeal of their offering.

Diverse Customer Base: Oklo's model allows them to target a wide range of sectors, including data centers, defense, oil and gas, real estate, industrial facilities, and utilities. This diversification helps mitigate market risks.

Partnerships: Strategic partnerships, such as those with Diamondback Energy and Centrus Energy Corp, play a crucial role in Oklo's business model, providing avenues for deployment and growth.

By focusing on selling power rather than reactors, Oklo positions itself as an energy service provider rather than just a technology vendor. This approach aligns with the growing trend of "energy-as-a-service" models and could potentially accelerate the adoption of advanced nuclear technology in various industries.

Key Products and Services

Oklo Inc. focuses on providing clean, reliable, and affordable energy through its innovative nuclear technology. The company's primary offerings revolve around its Aurora powerhouse product line. Here's a detailed look at Oklo's key products and services:

Aurora Powerhouse

The Aurora powerhouse is Oklo's flagship product, a small-scale nuclear power plant designed to generate clean electricity and heat. Key features include:

- Power Output: Scalable from 15 MWe to 50 MWe of electrical power

- Reactor Type: Compact fast neutron reactor using liquid metal cooling

- Fuel: Utilizes recycled nuclear waste as fuel

- Operational Lifespan: Can operate for up to 10 years without refueling

- Applications: Suitable for data centers, remote communities, industrial sites, and military bases

Power Purchase Agreements (PPAs)

Oklo offers long-term Power Purchase Agreements to customers, typically spanning 20 years with options to extend. This service includes:

- Reliable, 24/7 clean energy supply

- Customized power solutions based on customer needs

- Simplified access to nuclear energy without the complexities of ownership

Heat and Cogeneration

In addition to electricity, Oklo's powerhouses can provide usable heat, enabling:

- Industrial process heat applications

- District heating for communities

- Cogeneration opportunities for improved energy efficiency

Fuel Recycling Services

Oklo is developing capabilities in nuclear fuel recycling, which offers:

- Reduction of nuclear waste

- More efficient use of nuclear fuel resources

- Potential cost savings in fuel procurement

Radioisotope Production

Leveraging its nuclear technology, Oklo plans to produce radioisotopes for various applications:

- Medical diagnostic imaging and cancer treatment

- Industrial uses such as non-destructive testing

- Energy applications including nuclear batteries and fusion research

Consulting and Design Services

While not explicitly stated, Oklo's expertise in advanced nuclear technology positions them to offer:

- Consulting services for clean energy transitions

- Custom design solutions for specific energy needs

- Feasibility studies for nuclear power integration

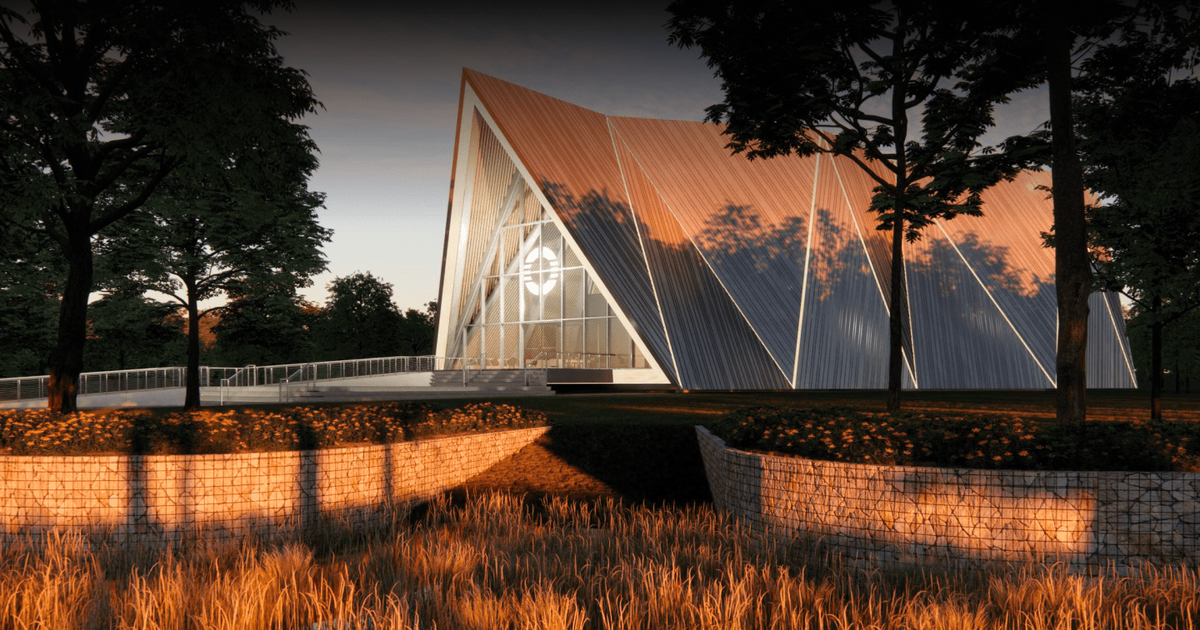

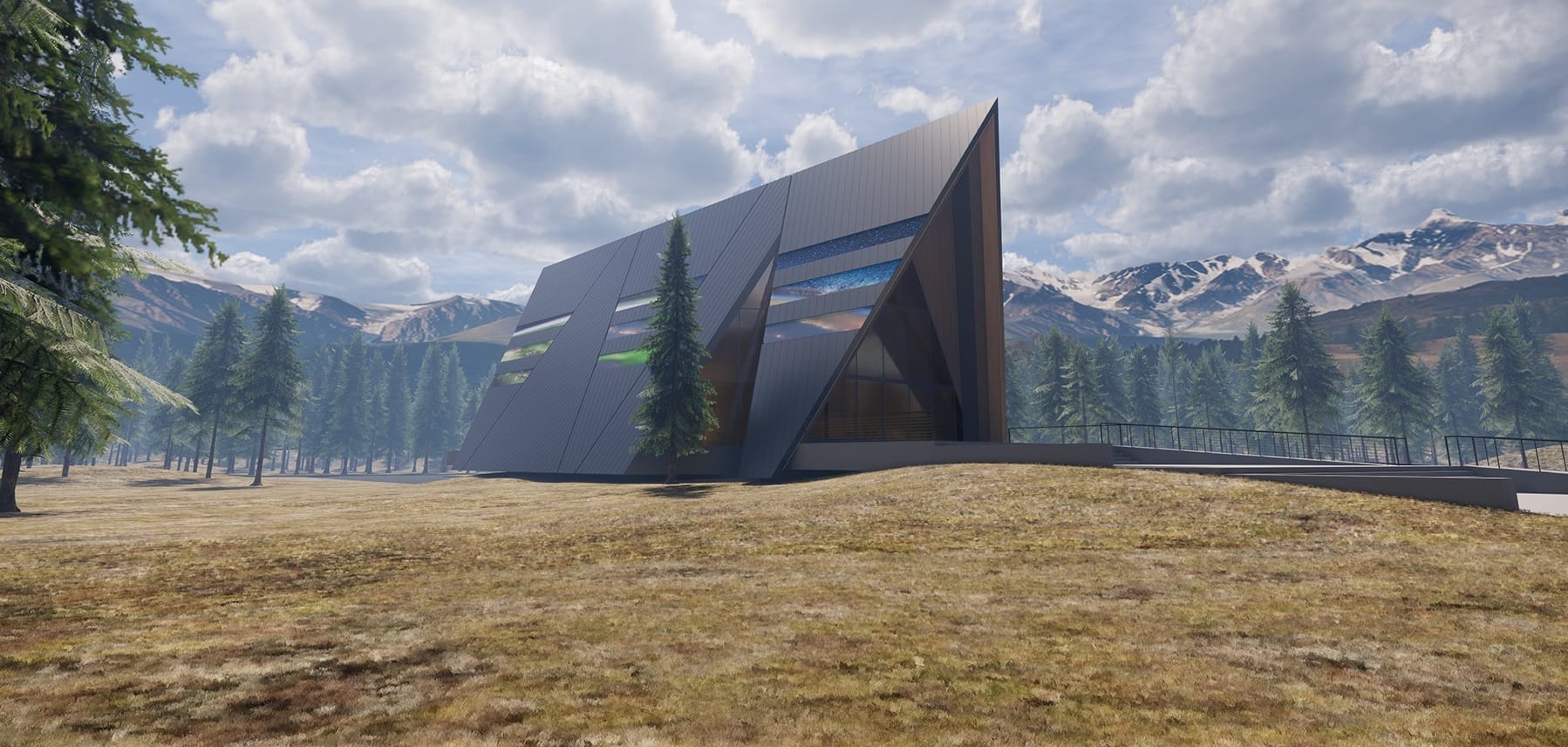

Modular Architecture Design

In collaboration with Gensler architects, Oklo has developed an award-winning modular architecture for the Aurora Powerhouse, which offers:

- Simplified and streamlined construction capabilities

- Aesthetic integration into various environments

- Potential for rapid deployment and scalability

By offering these products and services, Oklo aims to revolutionize the energy sector, providing clean, safe, and affordable nuclear power solutions to a wide range of customers and applications.

Management Team

Oklo Inc. boasts a strong leadership team with extensive experience in nuclear technology, energy, and business management. Here's an overview of the key members:

Executive Leadership

Jacob DeWitte - Co-Founder and CEO

- MIT graduate with expertise in nuclear engineering

- Leads Oklo's overall strategy and vision

Caroline Cochran - Co-Founder and COO

- MIT graduate with a background in nuclear engineering

- Oversees Oklo's operations and regulatory affairs

R. Craig Bealmear - Chief Financial Officer

- Over 30 years of leadership experience in publicly traded energy companies

- Responsible for Oklo's financial strategy and investor relations

Board of Directors

Sam Altman - Chairman

- CEO of OpenAI and former president of Y Combinator

- Provides strategic guidance and has been involved with Oklo since 2015

Michael Klein - Board Member

- Former Chairman of AltC Acquisition Corp.

- Brings extensive experience in finance and mergers & acquisitions

Lieutenant General (Ret.) John Jansen - Board Member

- Retired United States Marine Corps officer

- Offers expertise in defense and energy security

Richard Kinzley - Board Member

- Retired Chief Financial Officer of Black Hills Corporation (NYSE: BKH)

- Contributes financial and utility industry experience

Chris Wright - Board Member

- CEO of Liberty Energy Inc. (NYSE: LBRT)

- Provides insights from the energy sector

Key Personnel

While not explicitly mentioned in the search results, Oklo likely has additional key personnel in areas such as:

- Chief Technology Officer

- Head of Regulatory Affairs

- Vice President of Business Development

- Director of Human Resources

Oklo's management team combines nuclear technology expertise with business acumen, positioning the company to navigate the complex landscape of advanced nuclear energy development and commercialization. The diverse backgrounds of the board members further strengthen Oklo's strategic positioning in the energy sector.

Industry and Market Analysis

The advanced nuclear energy sector, where Oklo Inc. operates, is experiencing significant growth and transformation driven by the global push for clean energy solutions. Here's an analysis of the industry and market landscape:

Market Size and Growth

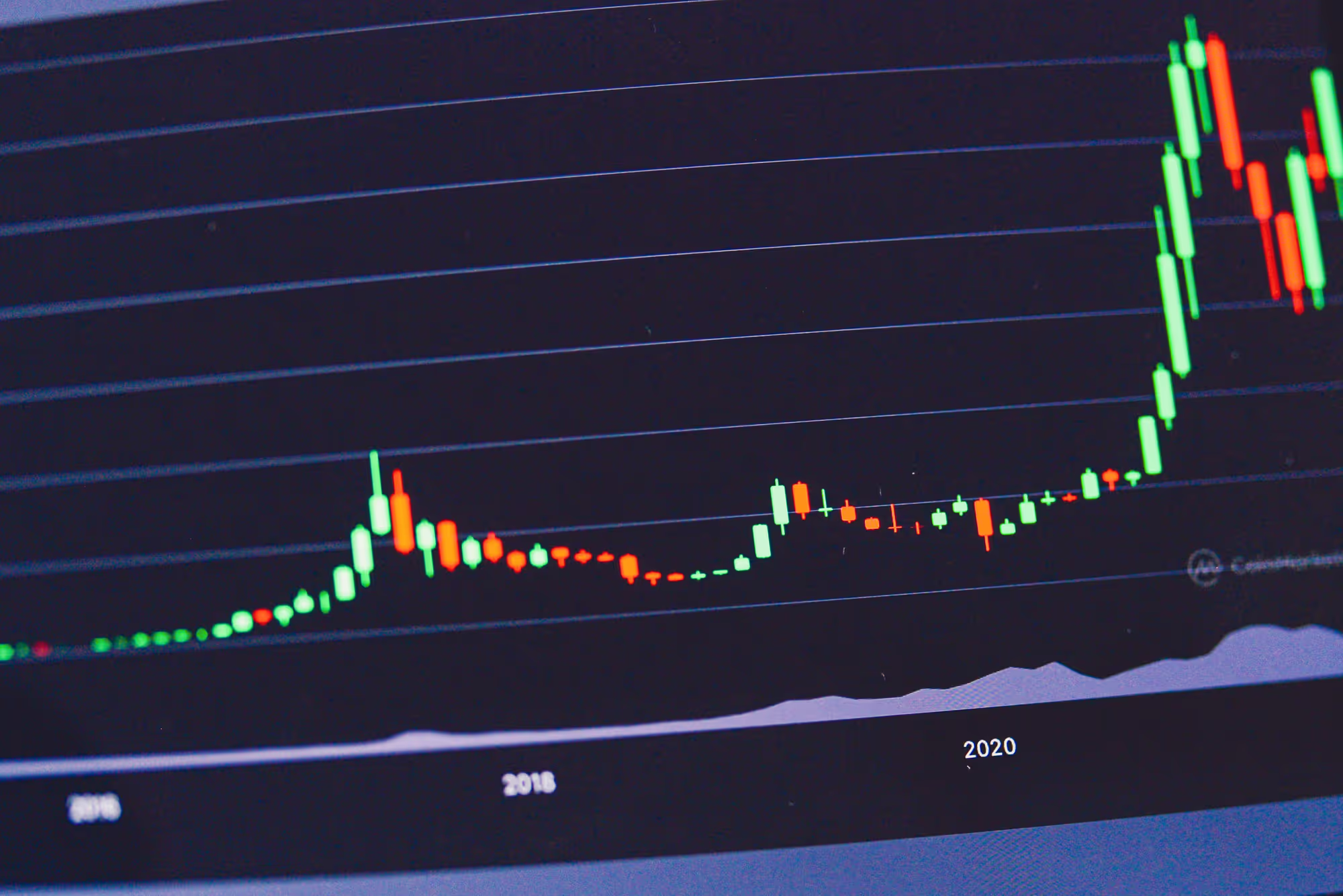

The global nuclear power market is projected to reach $28 billion by 2030, with advanced nuclear technologies playing an increasingly important role. Oklo's customer pipeline has nearly doubled since July 2023, growing from approximately 700 MW to 1,350 MW by August 2024, indicating strong market interest in their technology.

Competitive Landscape

Oklo has positioned itself as a leader in the advanced nuclear sector with several key advantages:

- First-mover advantage: Oklo has made significant regulatory progress, including obtaining the first advanced reactor site use permit and submitting the first advanced reactor combined license application.

- Unique business model: The company's Build, Own, Operate model, focusing on selling power rather than reactors, sets it apart from traditional nuclear companies.

- Diverse customer base: Oklo's scalable technology has attracted interest from various sectors, including data centers, defense, oil and gas, real estate, industrials, and utilities.

Industry Trends

Several trends are shaping the advanced nuclear industry:

- Increasing demand for clean energy: The global push for decarbonization is driving interest in nuclear power as a reliable, carbon-free energy source.

- Focus on small modular reactors (SMRs): Oklo's Aurora powerhouse, with its scalable design from 15 MW to 50 MW, aligns with the industry trend towards smaller, more flexible nuclear solutions.

- Nuclear fuel recycling: Oklo's technology can utilize recycled nuclear waste, addressing a key challenge in the industry and potentially reducing fuel costs by over 80%.

- Integration with AI and data centers: The growing energy demands of artificial intelligence and data centers are creating new market opportunities for advanced nuclear technologies.

Market Opportunities

Oklo is well-positioned to capitalize on several market opportunities:

- Data center power: The rapid growth of data centers, particularly those supporting AI technologies, presents a significant market for reliable, clean energy.

- Industrial applications: Oklo's ability to provide both electricity and heat opens up opportunities in industrial processes and district heating.

- Defense sector: The company's selection as a contractor for siting a micro-reactor at Eielson Air Force Base demonstrates potential in the defense market.

- Fuel recycling services: Oklo's nuclear fuel recycling technology could create an additional revenue stream and address environmental concerns.

By leveraging its innovative technology, unique business model, and strategic partnerships, Oklo is poised to capture a significant share of the growing advanced nuclear market. The company's focus on scalable, clean energy solutions aligns well with global trends towards decarbonization and increased electrification across various industries.

Market Size and Growth

Oklo Inc. is positioning itself as a key player in the rapidly growing advanced nuclear energy market. The global nuclear power market, currently valued at approximately $215.19 billion in 2023, is projected to reach $278.49 billion by 2028, growing at a CAGR of 5.2%. This growth is driven by increasing energy demands, climate change mitigation efforts, and the need for reliable, clean power sources.

Oklo's innovative approach to nuclear technology aligns well with market trends, particularly the growing interest in small modular reactors (SMRs). The company's Aurora powerhouse, with its scalable design from 15 MW to 50 MW, is well-positioned to capture a significant share of this emerging market segment.

The company has seen remarkable growth in its customer pipeline, nearly doubling from approximately 700 MW to 1,350 MW between July 2023 and August 2024. This surge in interest reflects the strong market demand for Oklo's scalable technology and unique business model, which includes both power generation and nuclear fuel recycling services.

Oklo's market potential is further bolstered by the growing energy demands of data centers and AI technologies, as well as interest from diverse sectors including defense, oil and gas, real estate, and utilities. The company's selection for a micro-reactor project at Eielson Air Force Base demonstrates its potential in the defense market.

With the global push towards clean energy solutions and the ADVANCE Act providing regulatory support for advanced nuclear technologies, Oklo is well-positioned to capitalize on the growing market for innovative nuclear solutions. As the company progresses towards its first commercial deployments, it has the potential to capture a significant share of the expanding advanced nuclear market.

Competetive Landscape

Key Competitors

- NuScale Power: A leader in small modular reactor (SMR) technology, NuScale is actively developing projects in Central and Eastern Europe, including a significant project in Poland.

- TerraPower: Founded by Bill Gates, TerraPower has secured substantial federal funding and is developing its Natrium reactor in Wyoming.

- Westinghouse Electric Company: Known for its eVinci micro reactor, Westinghouse offers a transportable nuclear power solution.

- BWXT Technologies: Selected by the U.S. Department of Defense to build the first advanced nuclear microreactor in the United States.

- Kairos Power: Focusing on molten salt reactor technology, Kairos Power is another player in the advanced nuclear space.

Oklo's Competitive Edge

Oklo differentiates itself in several ways:

- Unique Business Model: Oklo's Build, Own, Operate model sets it apart from traditional reactor manufacturers, offering power directly to customers under long-term contracts.

- Advanced Technology: The Aurora powerhouse microreactor, scalable from 15 MW to 50 MW, uses fast reactor technology and can operate on recycled nuclear fuel.

- Regulatory Progress: Oklo has made significant strides in the regulatory landscape, including obtaining the first advanced reactor site use permit from the U.S. Department of Energy.

- Market Focus: The company targets diverse sectors, including data centers, AI companies, remote communities, and industrial facilities.

- Partnerships: Strategic collaborations with companies like Diamondback Energy Inc. and Centrus Energy Corp strengthen Oklo's position in the market.

Market Positioning

Oklo's recent public listing on the New York Stock Exchange and the $306 million in gross proceeds from its business combination provide significant financial resources to compete in the market.

The company's focus on small, scalable reactors and its ability to use recycled nuclear fuel position it well in the growing market for clean, reliable energy solutions. As the demand for sustainable power sources continues to rise, particularly in sectors like data centers and AI, Oklo's innovative approach could give it a competitive edge in the evolving nuclear energy landscape.

Industry Trends

Industry Trends in Nuclear Energy

The nuclear energy industry is experiencing a renaissance, driven by technological advancements, growing energy demands, and the urgent need for clean power solutions. Here are some key trends shaping the future of nuclear energy:

Advanced Reactor Designs

The industry is seeing significant progress in advanced reactor designs, particularly small modular reactors (SMRs) and microreactors. These new designs promise enhanced safety features, improved efficiency, and greater flexibility in deployment. Companies like NuScale Power and TerraPower are at the forefront of this innovation.

Integration with Renewable Energy

Nuclear power is increasingly viewed as complementary to renewable energy sources. The industry is exploring ways to integrate nuclear plants with variable renewables, enhancing grid stability and supporting the production of clean hydrogen for hard-to-decarbonize sectors.

Digital Transformation

The adoption of digital technologies is revolutionizing nuclear plant operations, maintenance, and safety protocols. Artificial Intelligence (AI) and machine learning are being employed to optimize plant performance and enhance predictive maintenance.

Sustainability Focus

There's a growing emphasis on improving the sustainability of nuclear power. This includes efforts to enhance fuel efficiency, reduce waste, and develop advanced fuel cycles that can use recycled nuclear waste as fuel.

Global Expansion

Emerging markets, particularly in Asia, are driving significant growth in nuclear capacity. China is set to become the world's largest nuclear power producer by 2030, with ambitious plans for new reactor construction.

Policy Support

Many countries are revising their energy policies to support nuclear power as a key component of their clean energy strategies. The pledge by over 20 countries to triple global nuclear capacity by 2050 underscores this trend.

Fusion Energy Progress

While still in the research phase, fusion energy is gaining momentum with significant investments from both public and private sectors. Breakthroughs in this field could revolutionize the energy landscape in the coming decades.

Regulatory Evolution

Regulatory frameworks are adapting to accommodate new reactor designs and technologies. This includes streamlined processes for licensing advanced reactors and updated safety standards reflecting technological advancements.

As the nuclear industry continues to evolve, these trends are shaping a future where nuclear energy plays a crucial role in meeting global energy demands while supporting climate change mitigation efforts.

Financial Analysis

Oklo Inc., a pioneering company in the advanced nuclear energy sector, presents an intriguing financial profile that reflects both its innovative potential and the challenges of operating in a capital-intensive, highly regulated industry.

Revenue and Profitability

As of the latest financial reports, Oklo is currently unprofitable, which is not uncommon for early-stage companies in the advanced technology sector. The company has yet to generate significant revenue, as it is still in the development and regulatory approval stages for its Aurora powerhouse technology.

Cash Position and Burn Rate

One of Oklo's key financial strengths is its robust cash position. As of the second quarter of 2024, the company reported $294.6 million in cash, with no debt on its balance sheet. This substantial cash reserve is crucial for Oklo's operations, as it provides a runway for continued research, development, and regulatory processes.

Balance Sheet Health

Oklo's balance sheet appears healthy, with total assets of $299.19 million and total liabilities of $29.88 million as of the latest reporting period. The company's debt-to-equity ratio stands at 0%, reflecting its debt-free status. This strong financial position provides Oklo with flexibility and stability as it progresses towards commercialization.

Research and Development Expenses

Given its focus on developing advanced nuclear technology, Oklo invests heavily in research and development. In the first quarter of 2024, the company reported R&D expenses of $3,660,642, a significant increase from the same period in the previous year.

Market Valuation

Despite being pre-revenue, Oklo has attracted significant investor interest. As of October 2024, the company's market capitalization stood at approximately $1.19 billion. This valuation reflects investor confidence in Oklo's potential to disrupt the energy sector with its innovative nuclear technology.

Future Projections

Analysts project that Oklo could generate revenue of $86.2 million by fiscal year 2028, with an estimated EBITDA of $23.5 million. These projections underscore the long-term nature of nuclear energy projects and the anticipated growth as Oklo transitions from development to commercial operations.

Conclusion

Oklo's financial profile is characteristic of a high-potential, early-stage company in a capital-intensive industry. While currently unprofitable, its strong cash position, debt-free status, and growing market interest provide a solid foundation for future growth. However, investors should be aware of the long timelines typical in the nuclear industry and the regulatory challenges that could impact Oklo's path to profitability.

As Oklo progresses towards deploying its first Aurora powerhouse and expanding its customer pipeline, its financial performance will be a key area to watch for investors and industry observers alike.

Historical Performance

Oklo Inc., a pioneering company in the advanced nuclear energy sector, has shown a trajectory typical of innovative startups in capital-intensive industries. While the company is still pre-revenue, its historical performance can be evaluated through key milestones, regulatory achievements, and financial developments.

Regulatory and Technological Milestones

Since its founding in 2013, Oklo has made significant strides in the regulatory landscape:

- In 2019, Oklo received the first advanced reactor site use permit from the U.S. Department of Energy for its Aurora powerhouse at Idaho National Laboratory.

- The company submitted the first advanced reactor combined license application to the U.S. Nuclear Regulatory Commission, marking a crucial step towards commercialization.

Financial Development

Oklo's financial journey reflects its status as a pre-revenue company focused on research and development:

- As of June 30, 2024, Oklo reported total assets of $299 million, including $105.6 million in cash and cash equivalents.

- The company's R&D expenses have been increasing, reflecting its commitment to technological advancement. In Q1 2024, R&D expenses reached $3,660,642.

Market Valuation and Investor Confidence

Despite being pre-revenue, Oklo has attracted significant investor interest:

- In May 2024, Oklo went public through a merger with AltC Acquisition Corp, raising $306 million in gross proceeds.

- As of October 2024, the company's market capitalization stood at approximately $1.19 billion, reflecting strong investor confidence in its potential.

Strategic Partnerships

Oklo has secured key partnerships that strengthen its position in the energy sector:

- Collaborations with Diamondback Energy Inc. and Centrus Energy Corp demonstrate industry recognition of Oklo's potential.

- The company has also partnered with national laboratories, enhancing its technological capabilities and market credibility.

Customer Pipeline Growth

Oklo's unique approach has garnered interest across various sectors:

- The company's customer pipeline has grown significantly, nearly doubling from approximately 700 MW to 1,350 MW between July 2023 and August 2024.

While Oklo is yet to generate revenue, its historical performance shows steady progress in technology development, regulatory approval, and market positioning. The company's ability to attract substantial funding and partnerships, coupled with its growing customer pipeline, suggests a promising trajectory as it moves towards commercialization of its Aurora powerhouse technology.

Key Financial Metrics

Oklo Inc., an innovative player in the advanced nuclear energy sector, presents a unique financial profile characteristic of a pre-revenue company with high growth potential.

Cash Position and Liquidity

As of the second quarter of 2024, Oklo reported a robust cash position of $294.6 million. This substantial cash reserve is crucial for the company's ongoing operations, research, and development efforts. The company's liquidity is further strengthened by:

- $105.6 million in cash and cash equivalents

- $129.6 million in marketable securities

Burn Rate and Operational Expenses

Oklo's financial strategy reflects its stage of development:

- The company expects to burn through $35 million to $40 million in cash for the full year 2024.

- Research and development expenses reached $3,660,642 in Q1 2024, indicating significant investment in technology advancement.

Balance Sheet Strength

Oklo's balance sheet reflects its strong financial position:

- Total assets of $299 million as of June 30, 2024

- A debt-free status, with no long-term debt on the balance sheet

Market Valuation

Despite being pre-revenue, Oklo has attracted significant investor interest:

- Market capitalization of approximately $1.19 billion as of October 2024

- This valuation reflects investor confidence in Oklo's potential to disrupt the energy sector

Future Projections

Analysts have provided optimistic projections for Oklo's future performance:

- Projected revenue of $86.2 million by fiscal year 2028

- Estimated EBITDA of $23.5 million for the same period

Customer Pipeline Growth

Oklo's potential for future revenue is reflected in its growing customer interest:

- The company's customer pipeline has nearly doubled from approximately 700 MW to 1,350 MW between July 2023 and August 2024.

While Oklo is currently operating at a loss, which is typical for companies in the research and development phase, its strong cash position and growing market interest provide a solid foundation for future growth. The company's financial metrics reflect its status as a high-potential, early-stage company in a capital-intensive industry, with significant opportunities ahead as it moves towards commercialization of its advanced nuclear technology.

Key Financial Metrics Oklo Inc.

Oklo Inc., an innovative player in the advanced nuclear energy sector, presents a unique financial profile characteristic of a pre-revenue company with high growth potential. Here's an overview of Oklo's key financial metrics:

Cash Position and Liquidity

As of the second quarter of 2024, Oklo reported a robust cash position of $294.6 million. This substantial cash reserve is crucial for the company's ongoing operations, research, and development efforts. The company's liquidity is further strengthened by:

- $105.6 million in cash and cash equivalents

- $129.6 million in marketable securities

Burn Rate and Operational Expenses

Oklo's financial strategy reflects its stage of development:

- The company expects to burn through $35 million to $40 million in cash for the full year 2024.

- Research and development expenses reached $3,660,642 in Q1 2024, indicating significant investment in technology advancement.

Balance Sheet Strength

Oklo's balance sheet reflects its strong financial position:

- Total assets of $299 million as of June 30, 2024

- A debt-free status, with no long-term debt on the balance sheet

Market Valuation

Despite being pre-revenue, Oklo has attracted significant investor interest:

- Market capitalization of approximately $1.19 billion as of October 2024

- This valuation reflects investor confidence in Oklo's potential to disrupt the energy sector

Future Projections

Analysts have provided optimistic projections for Oklo's future performance:

- Projected revenue of $86.2 million by fiscal year 2028

- Estimated EBITDA of $23.5 million for the same period

Customer Pipeline Growth

Oklo's potential for future revenue is reflected in its growing customer interest:

- The company's customer pipeline has nearly doubled from approximately 700 MW to 1,350 MW between July 2023 and August 2024.

While Oklo is currently operating at a loss, which is typical for companies in the research and development phase, its strong cash position and growing market interest provide a solid foundation for future growth. The company's financial metrics reflect its status as a high-potential, early-stage company in a capital-intensive industry, with significant opportunities ahead as it moves towards commercialization of its advanced nuclear technology.

Quality of Earnings: Oklo Inc.

Analyzing the quality of earnings for Oklo Inc. presents a unique challenge, as the company is currently in a pre-revenue stage typical of innovative startups in the advanced nuclear energy sector. However, we can examine several factors that provide insights into the company's financial health and future potential.

Pre-Revenue Status

As of the latest financial reports, Oklo is currently unprofitable, which is not uncommon for companies in the research and development phase of advanced technologies. The absence of revenue means traditional earnings quality metrics are not applicable at this stage.

Research and Development Focus

Oklo's financial statements reveal a significant focus on research and development. In the first quarter of 2024, the company reported R&D expenses of $3,660,642, a substantial increase from the previous year. This investment in innovation is crucial for Oklo's future earnings potential but does impact current profitability.

Cash Position and Burn Rate

One of the key indicators of Oklo's financial health is its strong cash position. As of the second quarter of 2024, the company reported $294.6 million in cash, with no debt on its balance sheet. This robust cash reserve provides Oklo with a significant runway to continue its operations and development efforts.

Market Valuation and Investor Confidence

Despite being pre-revenue, Oklo has attracted significant investor interest, with a market capitalization of approximately $1.19 billion as of October 2024. This valuation reflects investor confidence in Oklo's potential to generate substantial earnings in the future.

Future Earnings Potential

Analysts project that Oklo could generate revenue of $86.2 million by fiscal year 2028, with an estimated EBITDA of $23.5 million. These projections, while speculative, provide a framework for assessing Oklo's future earnings quality.

Customer Pipeline Growth

Oklo's potential for future revenue is reflected in its growing customer interest. The company's customer pipeline has nearly doubled from approximately 700 MW to 1,350 MW between July 2023 and August 2024, indicating strong market demand for its technology.

Regulatory Progress

The quality of Oklo's future earnings is closely tied to its regulatory progress. The company has made significant strides, including obtaining the first advanced reactor site use permit from the U.S. Department of Energy and submitting the first advanced reactor combined license application to the U.S. Nuclear Regulatory Commission.

While traditional earnings quality metrics are not applicable to Oklo at this stage, the company's strong cash position, growing customer pipeline, and significant market valuation suggest investor confidence in its future earnings potential. As Oklo progresses towards commercialization of its Aurora powerhouse technology, the quality of its earnings will become more apparent and measurable.

Valuation Methodology Oklo Inc.

Valuing Oklo Inc. (NYSE: OKLO), an innovative company in the advanced nuclear energy sector, requires a multifaceted approach that considers its unique position as a pre-revenue company with significant growth potential. Here's an overview of the valuation methodologies used to assess Oklo's value:

Discounted Cash Flow (DCF) Analysis

The DCF method is fundamental in valuing Oklo, despite the challenges of projecting cash flows for a pre-revenue company:

- Projection Period: Typically 5-10 years, with Oklo's first commercial deployment targeted for 2027

- Revenue Projections: Based on analyst estimates of $86.2 million by fiscal year 2028

- Discount Rate: 10-12%, reflecting the higher risk associated with early-stage energy companies

- Terminal Value: Calculated using a growth rate of 2-3%, aligned with long-term economic projections

The DCF model for Oklo incorporates different scenarios to account for regulatory and technological uncertainties.

Comparable Company Analysis

While finding direct comparables for Oklo is challenging, this method provides context by examining similar companies in the advanced nuclear and clean energy sectors:

- Key Comparables: NuScale Power (NYSE: SMR), X-energy (NYSE: XE)

- Metrics Considered: EV/EBITDA, Price/Sales, EV/MW of pipeline capacity

- Adjustments: Applied to account for Oklo's pre-revenue status and unique technology

Precedent Transactions Analysis

Recent transactions in the advanced nuclear sector offer valuation insights:

- NuScale Power's merger with Spring Valley Acquisition Corp (2022)

- X-energy's merger with Ares Acquisition Corporation (2023)

These transactions provide benchmarks for valuing advanced nuclear technology companies.

Real Options Valuation

Given the high uncertainty and potential for technological breakthroughs, a real options approach is valuable:

- Considers the value of flexibility in project development and scaling

- Accounts for the option to delay or accelerate projects based on market conditions

- Particularly relevant for Oklo's modular reactor design and potential for multiple deployments

Sum of the Parts (SOTP) Valuation

This method values different aspects of Oklo's business separately:

- Core Reactor Technology: Valued based on DCF and comparable company analysis

- Fuel Recycling Technology: Considered as a separate business unit with its own growth potential

- Intellectual Property Portfolio: Valued based on its strategic importance and potential licensing opportunities

Market-Based Valuation

Oklo's current market capitalization of approximately $759.44 million provides a reference point, reflecting investor expectations and market sentiment.

Scenario Analysis

Given the uncertainties in Oklo's path to commercialization, scenario analysis is crucial:

- Best Case: Rapid regulatory approval and successful technology deployment

- Base Case: Moderate delays but ultimate success in commercialization

- Worst Case: Significant regulatory hurdles or technological setbacks

Each scenario is assigned a probability, with the weighted average providing a risk-adjusted valuation.

Conclusion

Valuing Oklo Inc. requires a combination of these methodologies, each offering unique insights into the company's potential value. The pre-revenue nature of Oklo, coupled with the long-term and capital-intensive characteristics of the nuclear industry, makes valuation particularly challenging.

Investors and analysts should consider these various approaches holistically, recognizing that Oklo's true value lies in its potential to disrupt the energy sector with its advanced nuclear technology. As the company progresses towards commercialization, regular reassessment of these valuation methods will be essential to capture Oklo's evolving market position and growth prospects.

Sensitivity Analysis Oklo Inc.

Conducting a sensitivity analysis for Oklo Inc. (NYSE: OKLO) is crucial given the company's innovative technology and the uncertainties inherent in the advanced nuclear energy sector. This analysis helps investors understand how changes in key variables can impact Oklo's valuation and potential returns.

Key Variables for Sensitivity Analysis

- Revenue Projections

- Discount Rate

- Regulatory Approval Timeline

- Capital Expenditure (CapEx)

- Operating Costs

- Market Penetration Rate

Revenue Sensitivity

Based on analyst projections of $86.2 million revenue by fiscal year 2028, we can examine how changes in this projection affect Oklo's valuation:

| Revenue Change | Projected Revenue ($ million) | Estimated Valuation ($ million) |

|---|---|---|

| -20% | 68.96 | 607.55 |

| -10% | 77.58 | 683.50 |

| Base Case | 86.20 | 759.44 |

| +10% | 94.82 | 835.38 |

| +20% | 103.44 | 911.33 |

This analysis shows that a 20% change in projected revenue could lead to approximately a 20% change in Oklo's valuation, highlighting the significance of revenue projections.

Discount Rate Sensitivity

The choice of discount rate significantly impacts Oklo's valuation due to its pre-revenue status and long-term projects:

| Discount Rate | Estimated Valuation ($ million) |

|---|---|

| 8% | 948.05 |

| 10% (Base) | 759.44 |

| 12% | 616.39 |

| 14% | 506.29 |

A 2% change in the discount rate can lead to a 20-25% change in valuation, underscoring the importance of accurately assessing Oklo's risk profile.

Regulatory Approval Timeline

Oklo's valuation is highly sensitive to its regulatory approval timeline:

| Approval Delay | Estimated Valuation ($ million) |

|---|---|

| No Delay | 759.44 |

| 6 Months | 683.50 |

| 1 Year | 607.55 |

| 2 Years | 455.66 |

This analysis assumes that delays in regulatory approval directly impact the timeline for revenue generation and market penetration.

Capital Expenditure (CapEx) Sensitivity

Changes in CapEx for Oklo's Aurora powerhouse deployment can significantly affect valuation:

| CapEx Change | Estimated Valuation ($ million) |

|---|---|

| -20% | 911.33 |

| -10% | 835.38 |

| Base Case | 759.44 |

| +10% | 683.50 |

| +20% | 607.55 |

This analysis assumes that changes in CapEx directly impact Oklo's cash flows and, consequently, its valuation.

Operating Cost Sensitivity

Variations in projected operating costs can affect Oklo's profitability and valuation:

| Operating Cost Change | Estimated Valuation ($ million) |

|---|---|

| -20% | 873.36 |

| -10% | 816.40 |

| Base Case | 759.44 |

| +10% | 702.48 |

| +20% | 645.52 |

Market Penetration Rate

The rate at which Oklo captures market share is crucial for its valuation:

| Market Penetration | Estimated Valuation ($ million) |

|---|---|

| Low (50% of Base) | 379.72 |

| Base Case | 759.44 |

| High (150% of Base) | 1,139.16 |

This analysis assumes that market penetration directly correlates with revenue generation and growth potential.

Conclusion

This sensitivity analysis demonstrates that Oklo's valuation is particularly sensitive to changes in revenue projections, discount rates, and regulatory timelines. The company's pre-revenue status and the long-term nature of nuclear projects amplify the impact of these variables.

Investors should consider these sensitivities when evaluating Oklo as an investment opportunity. The wide range of potential valuations underscores the importance of closely monitoring Oklo's progress in regulatory approvals, technology development, and market penetration.

As Oklo moves closer to commercialization, the accuracy of these projections and the company's ability to meet key milestones will be crucial in determining its actual value. Regular updates to this sensitivity analysis will be necessary as new information becomes available and as Oklo progresses through its development and deployment phases.

Targeted Price Range Oklo Inc.

Oklo Inc. (NYSE: OKLO), an innovative player in the advanced nuclear energy sector, has attracted significant attention from investors and analysts. Determining a targeted price range for Oklo requires careful consideration of various factors, including market conditions, company performance, and future projections.

Current Market Performance

As of the latest data, Oklo's stock has shown considerable volatility:

- The stock hit a 52-week low of $5.35 on September 9, but has since experienced a remarkable surge.

- Recently, the stock reached an all-time high of $19.72, more than tripling in value over a six-week period.

- This surge has propelled Oklo's market capitalization to exceed $2.4 billion.

Analyst Projections

While specific long-term price targets are limited due to Oklo's early-stage status, some analysts have provided insights:

- B. Riley initiated coverage with a Buy rating and a $10.00 price target, highlighting Oklo's regulatory advantages and innovative business model.

- Analysts project revenue of $86.2 million and EBITDA of $23.5 million by fiscal year 2028.

Factors Influencing Price Range

Several key factors contribute to determining Oklo's targeted price range:

- Regulatory Milestones: Oklo's stock price is highly sensitive to regulatory progress. The company expects to submit its Combined License Application (COLA) in late 2024 or early 2025, with potential NRC licensing between 2026 and 2027.

- Customer Pipeline Growth: Oklo's customer pipeline has nearly doubled from 700 MW to 1,350 MW in just over a year, indicating strong market interest.

- Technological Advancements: Progress in Oklo's Aurora powerhouse technology and fuel recycling capabilities could significantly impact valuation.

- Market Conditions: The growing demand for clean energy solutions and the "electrification of everything" trend could drive increased interest in advanced nuclear technologies.

- Financial Position: Oklo's strong cash position of $294.6 million provides a solid foundation for development and commercialization efforts.

Targeted Price Range

Considering these factors, a potential targeted price range for Oklo Inc. could be:

- Lower Bound: $8 - $10 per share

This range reflects a more conservative outlook, considering potential regulatory delays or market challenges. - Mid-Range: $12 - $15 per share

This range aligns with moderate growth projections and successful achievement of near-term milestones. - Upper Bound: $18 - $22 per share

This optimistic range assumes rapid regulatory approval, successful technology deployment, and strong market adoption.

It's important to note that this price range is speculative and subject to significant volatility given Oklo's early-stage status and the complex nature of the advanced nuclear industry. Investors should closely monitor Oklo's progress in achieving key regulatory and technological milestones, as these will be crucial in determining the company's long-term value and stock price performance.

As Oklo continues to develop its technology and move towards commercialization, the targeted price range may evolve to reflect new developments, market conditions, and the company's ability to execute its innovative business model in the competitive clean energy landscape.

Investment Thesis Oklo Inc.

Oklo Inc. (NYSE: OKLO) presents a compelling investment opportunity in the rapidly evolving clean energy sector, particularly within the advanced nuclear technology space. As the world grapples with the dual challenges of increasing energy demand and the urgent need for decarbonization, Oklo's innovative approach to nuclear energy positions it at the forefront of a potential energy revolution.

Innovative Technology

At the heart of Oklo's investment thesis is its groundbreaking Aurora powerhouse technology. This advanced fast reactor design offers several key advantages:

- Scalable power output from 1.5 to 50 megawatts of electrical power

- Ability to operate for years without refueling

- Compact design suitable for various applications, from remote communities to industrial sites

- Potential to use recycled nuclear waste as fuel, addressing both energy production and waste management challenges

Growing Market Opportunity

The global push for clean energy solutions creates a substantial market opportunity for Oklo:

- The nuclear power market is projected to reach $28 billion by 2030

- Increasing demand for reliable, carbon-free baseload power to complement intermittent renewable sources

- Potential applications in sectors beyond traditional utilities, including data centers, industrial processes, and remote power generation

Strong Customer Interest

Oklo has demonstrated significant traction in the market:

- The company's customer pipeline has nearly doubled from approximately 700 MW to 1,350 MW between July 2023 and August 2024

- Diverse interest across sectors, including data centers, defense, oil and gas, and utilities

Regulatory Progress

Oklo has made substantial strides in the complex regulatory landscape of nuclear energy:

- Obtained the first advanced reactor site use permit from the U.S. Department of Energy

- Submitted the first advanced reactor combined license application to the U.S. Nuclear Regulatory Commission

- Engaged in pre-application discussions for commercial-scale reactors

Solid Financial Position

The company's financial strength provides a foundation for growth:

- Total assets of $299 million as of June 30, 2024

- A robust cash position of $294.6 million

- Debt-free balance sheet, providing financial flexibility

Experienced Leadership

Oklo boasts a strong management team with deep expertise in nuclear technology and energy markets:

- Co-founders Jacob DeWitte and Caroline Cochran bring technical expertise from their backgrounds at MIT

- The board includes industry veterans and notable figures like Sam Altman, CEO of OpenAI

Potential Catalysts

Several factors could drive Oklo's value in the near to medium term:

- Regulatory approvals and licensing milestones

- Successful deployment of the first commercial Aurora powerhouse

- Strategic partnerships or customer agreements in key sectors

- Technological breakthroughs in reactor design or fuel recycling

Risks to Consider

While the investment thesis is strong, potential investors should be aware of key risks:

- Regulatory hurdles and potential delays in the approval process

- Competition from other advanced nuclear technologies and alternative clean energy sources

- Execution risks associated with scaling up from prototype to commercial deployment

- Public perception and acceptance of nuclear energy

Conclusion

Oklo Inc. represents a high-potential investment opportunity in the clean energy sector. Its innovative technology, growing market opportunity, and strong financial position position the company to potentially lead in the next generation of nuclear energy. While risks exist, particularly given the pre-revenue status and regulatory complexities, Oklo's progress to date and the increasing global focus on clean energy solutions provide a compelling case for long-term value creation.

As the company moves towards commercialization, early investors have the opportunity to participate in what could be a transformative player in the global energy landscape. However, as with any investment in an emerging technology company, thorough due diligence and a long-term perspective are essential.

Growth Drivers Oklo Inc.

Oklo Inc. (NYSE: OKLO) is positioned at the forefront of the advanced nuclear energy sector, with several key growth drivers propelling its potential for significant expansion in the coming years.

Innovative Technology

At the core of Oklo's growth potential is its Aurora powerhouse technology. This advanced fast reactor design offers:

- Scalable power output from 15 MW to 50 MW

- Ability to operate for up to 10 years without refueling

- Compact design suitable for various applications

- Capability to use recycled nuclear waste as fuel

This innovative approach addresses many challenges faced by traditional nuclear power, positioning Oklo as a potential disruptor in the energy sector.

Expanding Market Demand

The global push for clean, reliable energy is creating substantial market opportunities:

- Growing demand for baseload power to complement intermittent renewable sources

- Increasing energy needs from data centers and AI companies

- Interest from industrial sectors seeking reliable, on-site power generation

- Potential applications in remote locations and for national defense

Oklo's customer pipeline has nearly doubled from approximately 700 MW to 1,350 MW between July 2023 and August 2024, indicating strong market interest.

Regulatory Progress

Oklo has made significant strides in navigating the complex regulatory landscape:

- Obtained the first advanced reactor site use permit from the U.S. Department of Energy

- Submitted the first advanced reactor combined license application to the U.S. Nuclear Regulatory Commission

- Engaged in pre-application discussions with the NRC for its commercial-scale reactors

These regulatory achievements position Oklo ahead of many competitors in the advanced nuclear sector.

Strategic Partnerships

Oklo has secured key partnerships that strengthen its market position:

- Agreements with Equinix Data Centers and Diamondback Energy for power supply

- Collaboration with Centrus Energy Corp for fuel supply

- Partnership with Wyoming Hyperscale for data center power

These partnerships provide a strong foundation for future growth and market expansion.

Favorable Policy Environment

The growing focus on clean energy solutions is driving supportive policies:

- The ADVANCE Act provides regulatory support for advanced nuclear technologies

- Increasing government interest in domestic clean energy production

- Global initiatives to reduce carbon emissions favoring nuclear as a clean energy source

Unique Business Model

Oklo's Build, Own, Operate model sets it apart in the nuclear industry:

- Selling power directly to customers under long-term contracts

- Reduced regulatory and construction burden for customers

- Potential for recurring revenue streams and attractive asset returns

Fuel Recycling Capability

Oklo's ability to use recycled nuclear waste as fuel provides:

- A solution to nuclear waste management challenges

- Potential cost advantages in fuel procurement

- Alignment with circular economy principles, enhancing environmental appeal

Scalability and Modular Design

The modular nature of Oklo's reactors allows for:

- Rapid deployment and scalability

- Potential for cost reductions through standardized manufacturing

- Flexibility in meeting varying power needs across different markets

Growing Investor Interest

Oklo's recent public listing and the increasing focus on clean energy investments provide:

- Access to capital for expansion and development

- Increased visibility in the investment community

- Potential for strategic investments or partnerships

Technological Advancements

Ongoing research and development in nuclear technology could lead to:

- Further improvements in reactor efficiency and safety

- Advancements in fuel cycle technology

- New applications for nuclear power in emerging industries

As Oklo continues to develop its technology and expand its market presence, these growth drivers position the company to potentially lead in the next generation of nuclear energy solutions. The combination of innovative technology, strong market demand, regulatory progress, and strategic partnerships creates a compelling growth narrative for Oklo in the evolving clean energy landscape.

Competitive Advantages Oklo Inc.

Oklo Inc. (NYSE: OKLO) has positioned itself as a unique player in the advanced nuclear energy sector, with several key competitive advantages that set it apart from both traditional nuclear companies and other innovative energy startups.

Innovative Reactor Design

Oklo's Aurora powerhouse technology offers significant advantages:

- Scalable power output from 15 MW to 50 MW, with potential for larger designs

- Ability to operate for up to 10 years without refueling

- Compact design suitable for various applications, from remote communities to industrial sites

- Inherent safety features, including passive cooling and self-stabilizing characteristics

These design features allow for flexible deployment and address many of the concerns associated with traditional nuclear power plants.

Unique Business Model

Oklo's Build, Own, Operate model differentiates it from traditional reactor manufacturers:

- Selling power directly to customers under long-term contracts

- Providing recurring revenue streams and potentially attractive asset returns

- Reducing regulatory and construction burden for customers

- Aligning Oklo's interests with those of its customers for long-term partnerships

This approach simplifies the adoption of nuclear power for customers while providing Oklo with stable, long-term income.

Fuel Recycling Capability

Oklo's technology can utilize recycled nuclear waste as fuel, offering several advantages:

- Addressing the nuclear waste management challenge

- Potential to reduce fuel costs by over 80%

- Tapping into the remaining 95% of energy left in spent uranium

- Aligning with circular economy principles, enhancing environmental appeal

This capability not only provides a cost advantage but also positions Oklo as a solution to a long-standing industry challenge.

Regulatory Progress

Oklo has made significant strides in the complex regulatory landscape:

- Obtained the first advanced reactor site use permit from the U.S. Department of Energy

- Submitted the first advanced reactor combined license application to the U.S. Nuclear Regulatory Commission

- Engaged in pre-application discussions for commercial-scale reactors

These achievements give Oklo a first-mover advantage in navigating the regulatory environment for advanced nuclear technologies.

Strategic Partnerships

Oklo has secured key partnerships that strengthen its market position:

- Agreements with major data center operators and energy companies

- Collaboration with fuel suppliers and national laboratories

- Support from influential figures in the tech industry, including Sam Altman as board chairman

These partnerships provide credibility, market access, and technological support.

Cost Competitiveness

Oklo's technology and business model position it to deliver emission-free power at competitive costs:

- Potential for lower levelized cost of electricity (LCOE) compared to other clean energy sources

- Reduced infrastructure and grid interconnection costs due to smaller reactor size

- Cost savings from fuel recycling and extended operational periods without refueling

Diverse Market Applications

Oklo's technology is suitable for a wide range of applications:

- Data centers and AI companies with high energy demands

- Remote communities and industrial sites requiring reliable power

- Defense applications for secure, independent power generation

- Utilities seeking to diversify their clean energy portfolio

This versatility allows Oklo to tap into multiple market segments and diversify its customer base.

Intellectual Property Portfolio

Oklo has developed a strong intellectual property position:

- Patents covering key aspects of its reactor design and fuel cycle technology

- Proprietary software and control systems for reactor operation

- Unique manufacturing and assembly processes for modular reactor components

This IP portfolio creates barriers to entry and protects Oklo's technological advantages.

Experienced Leadership Team

Oklo boasts a leadership team with deep expertise in nuclear technology and energy markets:

- Co-founders Jacob DeWitte and Caroline Cochran bring technical expertise from their backgrounds at MIT

- Board members include industry veterans and notable figures like Sam Altman, adding strategic insight and connections

Environmental Benefits

Oklo's technology offers significant environmental advantages:

- Zero-emission power generation

- Smaller physical footprint compared to traditional nuclear or renewable energy plants

- Potential to repurpose nuclear waste, addressing a critical environmental concern

By leveraging these competitive advantages, Oklo has positioned itself as a potentially disruptive force in the clean energy sector. The company's innovative approach to both technology and business model, combined with its regulatory progress and strategic partnerships, creates a strong foundation for growth in the evolving nuclear energy landscape.

Strategic Initiatives Oklo Inc.

Oklo Inc. has embarked on several strategic initiatives to solidify its position as a leader in the advanced nuclear energy sector and drive its growth trajectory. These initiatives reflect the company's innovative approach to both technology and market development.

Commercialization of Aurora Powerhouse

Oklo's primary focus is on bringing its Aurora powerhouse technology to market:

- Advancing through regulatory processes for first commercial deployment, with a target of 2027 at Idaho National Laboratory

- Scaling production capabilities for Aurora reactors

- Establishing a supply chain for critical components and materials, including a partnership with Siemens Energy

Expanding Customer Pipeline

Oklo is actively working to grow its customer base across various sectors:

- Engaging with data center operators, including a partnership with Equinix Data Centers

- Collaborating with energy companies like Diamondback Energy for industrial applications

- Exploring opportunities in remote power generation and defense sectors

The company's customer pipeline has nearly doubled from 700 MW to 1,350 MW in just over a year, indicating strong market interest.

Advancing Regulatory Approvals

Navigating the complex regulatory landscape is a key strategic focus:

- Pursuing a Part 52 licensing approach with the U.S. Nuclear Regulatory Commission

- Planning to submit a Combined License Application (COLA) in late 2024 or early 2025

- Engaging in pre-application discussions for commercial-scale reactors

Oklo's proactive approach to regulation aims to streamline future deployments and maintain its first-mover advantage.

Fuel Recycling Development

Oklo is investing in its fuel recycling capabilities:

- Advancing technology to efficiently use recycled nuclear waste as fuel

- Collaborating with partners like Centrus Energy Corp for fuel supply

- Exploring the establishment of a closed fuel cycle to enhance sustainability

Scaling Technology and Design

Oklo is working on scaling its reactor technology:

- Developing larger reactor configurations to address a broader range of power needs

- Enhancing the modularity and manufacturability of its reactors

- Investing in advanced manufacturing techniques to streamline production

Strategic Partnerships and Collaborations

Oklo continues to forge strategic partnerships to strengthen its market position:

- Collaborating with national laboratories for research and development

- Partnering with industry leaders in various sectors to expand applications

- Engaging with universities and research institutions to foster innovation

Public Education and Outreach

Recognizing the importance of public acceptance, Oklo is investing in education and outreach:

- Engaging with communities to address concerns about nuclear energy

- Participating in industry events and conferences to showcase technology

- Collaborating with environmental organizations to highlight the role of advanced nuclear in clean energy transitions

International Market Expansion

While initially focused on the U.S. market, Oklo is exploring international opportunities:

- Identifying potential markets for Aurora deployment globally

- Engaging with international regulatory bodies and energy agencies

- Exploring partnerships with international energy companies and utilities

By pursuing these strategic initiatives, Oklo aims to accelerate its growth, establish a strong market presence, and play a significant role in the global transition to clean energy. The company's multifaceted approach addresses technological development, market expansion, regulatory navigation, and public engagement, creating a comprehensive strategy for success in the advanced nuclear energy sector.

Risk Assessment Oklo Inc.

Investing in Oklo Inc. (NYSE: OKLO), an innovative company in the advanced nuclear energy sector, comes with a unique set of risks that potential investors should carefully consider. While the company's technology and business model offer significant potential, several key risk factors could impact its success and valuation.

Regulatory Risks

The nuclear industry is heavily regulated, and Oklo's success hinges significantly on navigating the Nuclear Regulatory Commission (NRC) approval process. Key regulatory risks include:

- Potential delays in obtaining NRC licensing for commercial deployment

- The possibility of additional regulatory requirements that could increase costs or extend timelines

- Challenges in setting precedents for licensing advanced reactor designs

Oklo's first license application was denied in 2022, highlighting the complexities of the regulatory landscape. While the company has incorporated learnings from this experience, future regulatory hurdles could impact its projected 2027 deployment timeline.

Technological Risks

As a company developing innovative nuclear technology, Oklo faces several technological risks:

- Potential unforeseen challenges in scaling up from prototype to commercial deployment

- Risks associated with the long-term performance and reliability of new reactor designs

- Potential issues with fuel supply and recycling processes

The company's Aurora powerhouse technology, while promising, has yet to be proven at a commercial scale.

Market and Competition Risks

Oklo operates in a competitive and rapidly evolving energy market:

- Competition from other advanced nuclear technologies and alternative clean energy sources

- Potential changes in energy policies that could favor other technologies

- Risks associated with long-term power purchase agreements and market price fluctuations

The company's unique owner-operator model, while potentially advantageous, also exposes it to market risks typically borne by utility companies.

Financial Risks

As a pre-revenue company, Oklo faces several financial risks:

- Potential for cost overruns in technology development and deployment

- Risks associated with future capital needs and potential dilution of shareholder value

- Sensitivity of project returns to fuel costs and power purchase agreement pricing

Analysts note that for a 15MW First Of A Kind (FOAK) plant, each $1,000/kg increase in fuel cost could lower the Internal Rate of Return (IRB) by 1-2 percentage points, highlighting the importance of managing costs effectively.

Public Perception Risks

Nuclear energy continues to face challenges in public acceptance:

- Potential opposition from local communities to reactor deployments

- Risks associated with public perception of nuclear safety and waste management

- Challenges in communicating the benefits of advanced nuclear technology to the public and policymakers

Execution Risks

As Oklo moves from development to commercialization, it faces execution risks:

- Challenges in scaling up manufacturing and deployment processes

- Potential issues in managing a growing portfolio of operational reactors

- Risks associated with building and maintaining a skilled workforce in a specialized field

Geopolitical and Supply Chain Risks

The nuclear industry is subject to geopolitical considerations and supply chain complexities:

- Potential impacts of international relations on nuclear fuel supply and technology transfer

- Risks associated with global supply chains for specialized components and materials

- Potential changes in international nuclear energy policies and agreements

While Oklo Inc. presents a compelling opportunity in the clean energy sector, potential investors should carefully weigh these risks against the company's potential rewards. The company's ability to navigate regulatory challenges, successfully deploy its technology, and manage financial and market risks will be crucial in determining its long-term success and value creation for shareholders.

Key Risks Oklo Inc.

Oklo Inc. (NYSE: OKLO), an innovative player in the advanced nuclear energy sector, faces several key risks that potential investors should carefully consider:

Regulatory Challenges

The nuclear industry is heavily regulated, and Oklo's success hinges significantly on navigating the Nuclear Regulatory Commission (NRC) approval process. Key regulatory risks include:

- Potential delays in obtaining NRC licensing for commercial deployment

- The possibility of additional regulatory requirements increasing costs or extending timelines

- Challenges in setting precedents for licensing advanced reactor designs

Oklo's first license application was denied in 2022, highlighting the complexities of the regulatory landscape. While the company has incorporated learnings from this experience, future regulatory hurdles could impact its projected 2027 deployment timeline.

Financial Risks

As a pre-revenue company, Oklo faces several financial risks:

- Negative return on assets of -49.78%, reflecting difficulties in generating income from its asset base

- Potential for cost overruns in technology development and deployment

- Risks associated with future capital needs and potential dilution of shareholder value

- Sensitivity of project returns to fuel costs and power purchase agreement pricing

Market and Competition Risks

Oklo operates in a competitive and rapidly evolving energy market:

- Competition from other advanced nuclear technologies and alternative clean energy sources

- Potential changes in energy policies that could favor other technologies

- Risks associated with long-term power purchase agreements and market price fluctuations

Technological Risks

As a company developing innovative nuclear technology, Oklo faces several technological risks:

- Potential unforeseen challenges in scaling up from prototype to commercial deployment

- Risks associated with the long-term performance and reliability of new reactor designs

- Potential issues with fuel supply and recycling processes

Stock Performance Risks

Oklo's stock has faced significant challenges:

- The stock hit a 52-week low of $5.45, reflecting market pressures

- High price volatility, which can offer opportunities for traders but also implies higher risk

- A sharp decline over the past year, with a one-year price total return of -46.04%

Execution Risks

As Oklo moves from development to commercialization, it faces execution risks:

- Challenges in scaling up manufacturing and deployment processes

- Potential issues in managing a growing portfolio of operational reactors

- Risks associated with building and maintaining a skilled workforce in a specialized field

Public Perception Risks

Nuclear energy continues to face challenges in public acceptance:

- Potential opposition from local communities to reactor deployments

- Risks associated with public perception of nuclear safety and waste management

- Challenges in communicating the benefits of advanced nuclear technology to the public and policymakers

While Oklo Inc. presents a compelling opportunity in the clean energy sector, these risks underscore the importance of thorough due diligence for potential investors. The company's ability to navigate regulatory challenges, successfully deploy its technology, and manage financial and market risks will be crucial in determining its long-term success and value creation for shareholders.

Mitigation Strategies Oklo Inc.

Oklo Inc. has implemented several strategies to mitigate the risks associated with its innovative approach to advanced nuclear energy. These strategies aim to address regulatory, financial, technological, and market challenges:

Regulatory Risk Mitigation

To navigate the complex regulatory landscape, Oklo has adopted a proactive approach:

- Engaging in ongoing dialogue with the Nuclear Regulatory Commission (NRC) to address concerns and streamline the approval process

- Participating in industry working groups to help shape regulatory frameworks for advanced reactors

- Leveraging lessons learned from its initial application to refine and strengthen future submissions

Oklo's strategy includes maintaining transparency with regulators and stakeholders, which can help build trust and potentially expedite the approval process.

Financial Risk Management

To address financial risks, Oklo has implemented several strategies:

- Maintaining a strong cash position, with $294.6 million in cash as of mid-2024

- Pursuing a diverse range of funding sources, including strategic partnerships and government grants

- Adopting a phased approach to technology deployment, allowing for cost management and risk mitigation at each stage

The company's Build, Own, Operate model also aims to provide long-term, stable revenue streams once operational.

Technological Risk Mitigation

Oklo is addressing technological risks through:

- Extensive testing and validation of its Aurora powerhouse design

- Collaborations with national laboratories and research institutions to leverage expertise and resources

- Investing in advanced modeling and simulation tools to predict and address potential issues before deployment

The company's focus on modular design also allows for incremental improvements and easier scalability.

Market and Competition Risk Management

To mitigate market risks, Oklo is:

- Diversifying its target markets, including data centers, industrial applications, and remote power generation

- Securing long-term power purchase agreements to provide revenue stability

- Developing strategic partnerships, such as with Equinix Data Centers and Diamondback Energy, to establish market presence

Oklo's unique technology and business model also help differentiate it from competitors in the clean energy space.

Execution Risk Mitigation

To address execution risks, Oklo is:

- Building a strong team with diverse expertise in nuclear technology, project management, and regulatory affairs

- Developing robust supply chain relationships to ensure access to critical components and materials

- Implementing rigorous project management and quality control processes

Public Perception Risk Management

Oklo is actively working to address public perception risks through:

- Engaging in community outreach and education programs to build understanding and support for advanced nuclear technology

- Emphasizing the safety features and environmental benefits of its Aurora powerhouse design

- Collaborating with environmental organizations and clean energy advocates to promote the role of advanced nuclear in addressing climate change

Intellectual Property Protection

To protect its technological advantages, Oklo:

- Maintains a robust patent portfolio covering key aspects of its reactor design and fuel cycle technology

- Implements strict confidentiality measures to safeguard proprietary information

- Strategically discloses information to balance transparency with competitive advantage protection

By implementing these mitigation strategies, Oklo aims to navigate the challenges inherent in developing and deploying advanced nuclear technology. While risks remain, these approaches demonstrate the company's proactive stance in addressing potential obstacles to its success.

The effectiveness of these strategies will be crucial in determining Oklo's ability to bring its innovative technology to market and establish itself as a leader in the clean energy sector. As the company progresses towards commercialization, investors and industry observers will be closely watching how well these mitigation strategies perform in practice.

Catalysts Oklo Inc.

Oklo Inc. (NYSE: OKLO), a pioneering company in the advanced nuclear energy sector, has several potential catalysts that could drive its growth and stock performance in the coming years. These catalysts span regulatory, technological, and market developments that could significantly impact the company's trajectory.

Regulatory Milestones

One of the most critical catalysts for Oklo is progress in the regulatory approval process. Key regulatory milestones include:

- Acceptance of Oklo's combined license application by the Nuclear Regulatory Commission (NRC)

- Approval of the company's first commercial reactor design

- Streamlining of the regulatory process for advanced nuclear technologies

Positive developments in these areas could significantly de-risk Oklo's business model and accelerate its path to commercialization.

Technological Advancements

Breakthroughs in Oklo's Aurora powerhouse technology could serve as powerful catalysts: